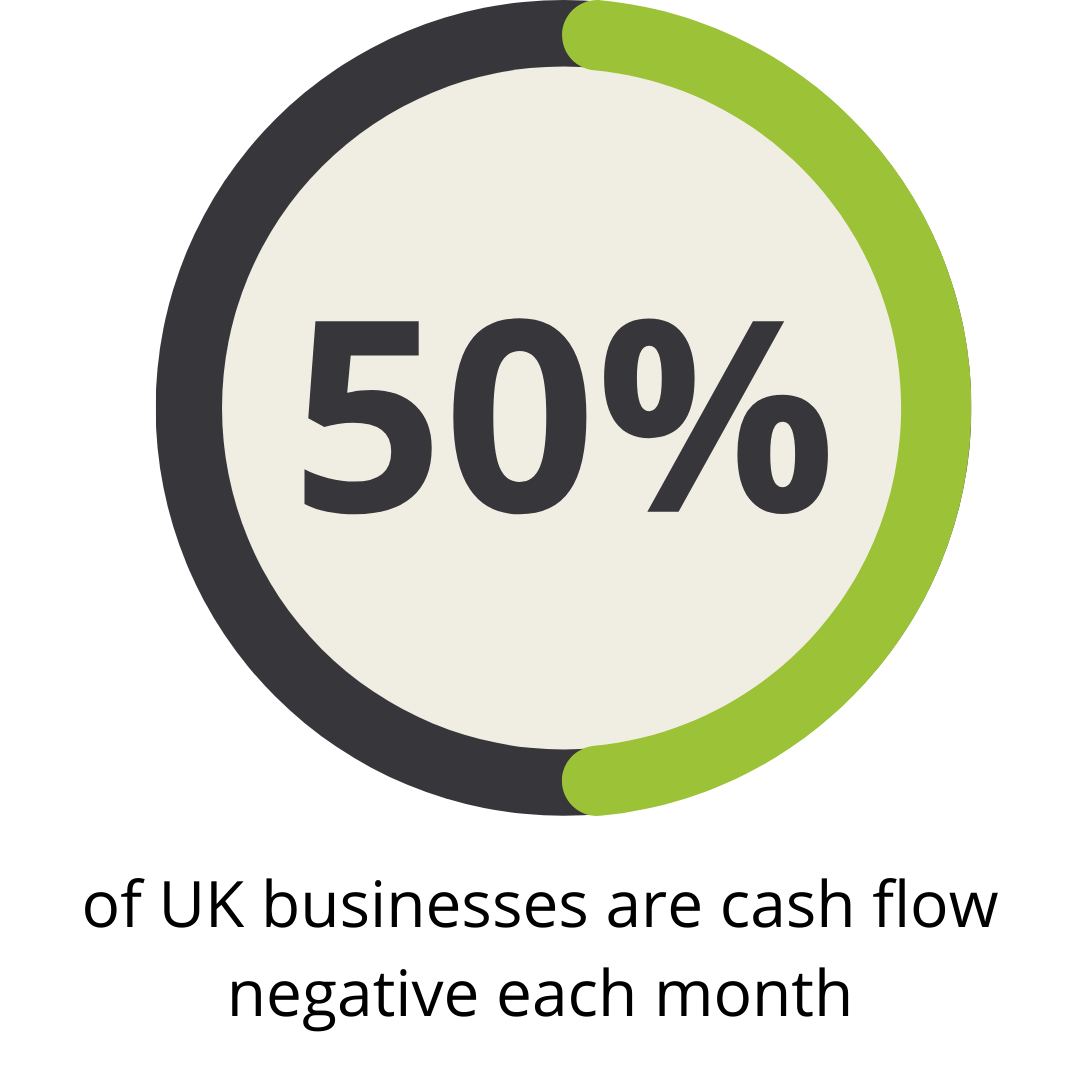

Managing cash is a struggle for many businesses across the UK. Even if a business

is profitable continued cash deficits can result in business failure.

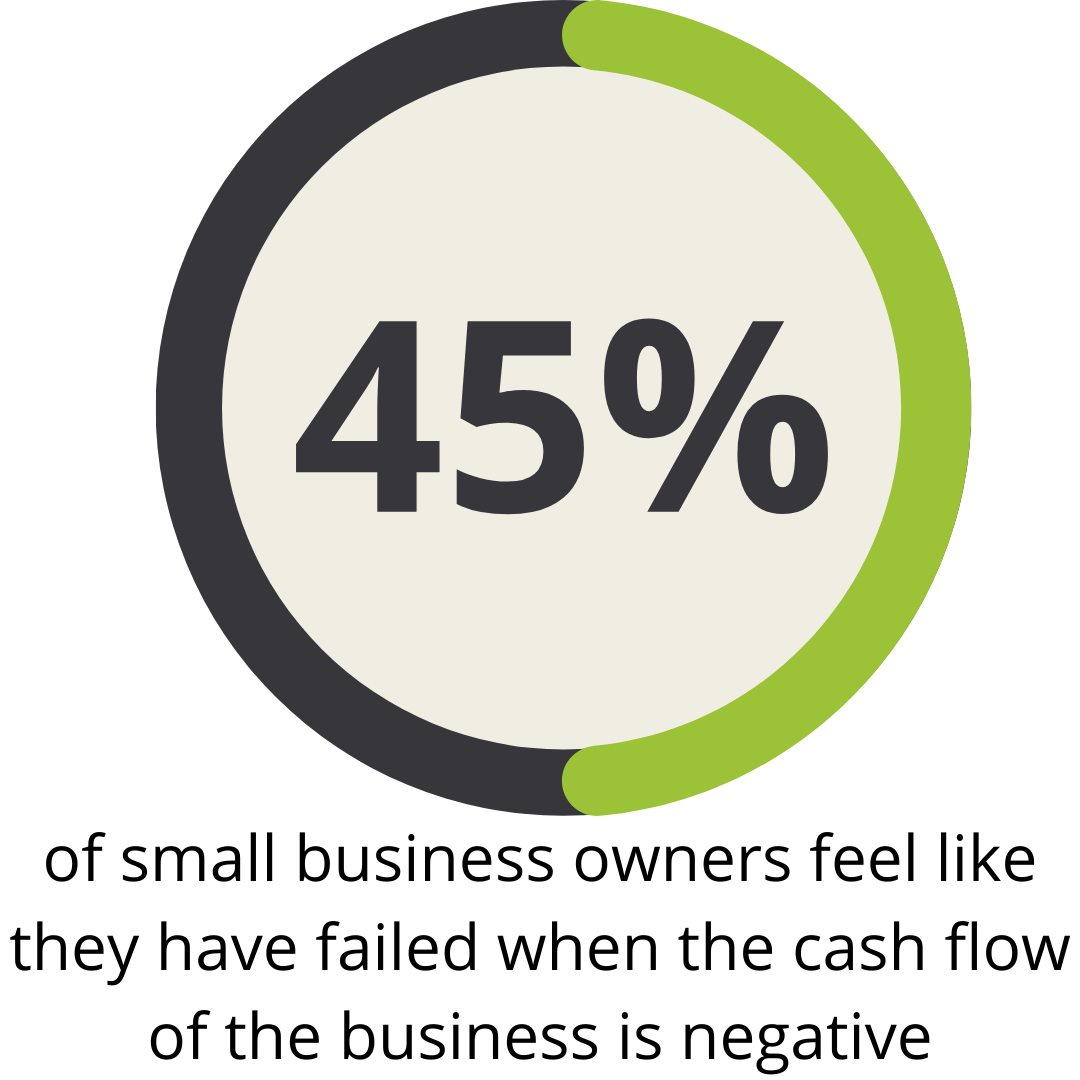

Moreover, the pressure of managing trade creditors, HMRC and legacy debts can

lead business owners to personally guarantee poor lines of credit that overtime place

an unmanageable burden on the company’s cash.

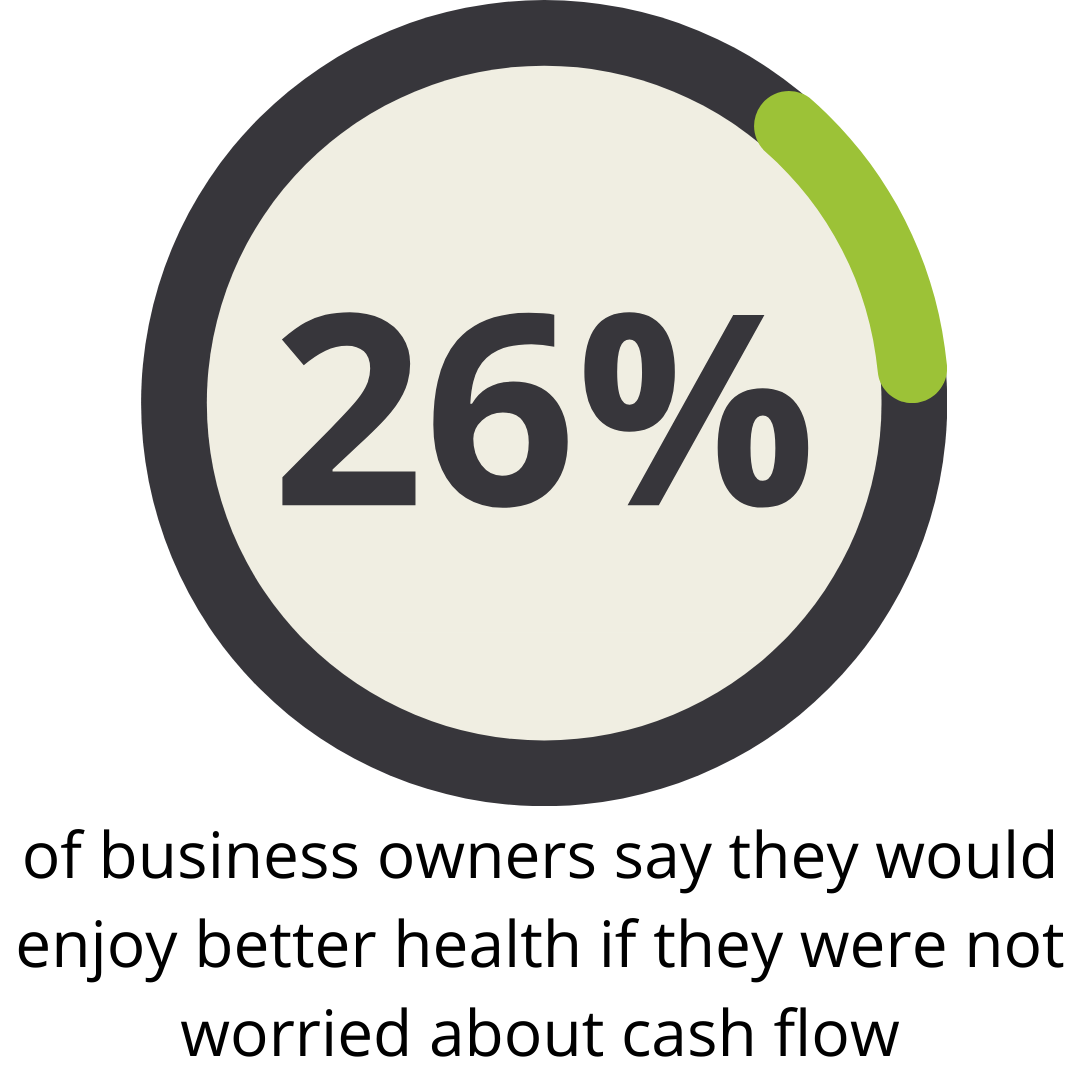

Understanding how to improve your cash flow and taking action to ensure your

business has the funding required to support its trading activities, is the first step on

your journey to cash flow success.

4R can help you understand how to improve your cash flow. From accessing real

time information on the performance of your business, managing and restructuring

legacy debt, securing favourable terms with new suppliers whilst protecting existing

ones and even accessing new sources of finance.

Whatever stage of the business lifecycle you’re in, cash is the lifeblood of any plan

for sustainable and scalable growth.